Businesses around the world are increasingly reliant on payment across borders. While these transactions drive global commerce and bridge geographical divides, they come with challenges complex, costly and frustrating. Fortunately, every problem has a solution.

What are Cross border payments?

The Bank for International Settlements (BIS) , in its report, defines cross-border payments as transactions where “the payer and the payee are in separate jurisdictions.” These means transactions typically involve bank transfers, digital wallets, or payment platforms, requiring currency conversions while navigating varying international payment systems.

Challenges Of Cross Border payment

1. Payments Are Too Expensive

Sending or receiving money internationally often costs more than it should. Banks add extra fees at every step, including converting one currency into another. If you’re a freelancer or small business, this can eat into your earnings.

2. Transactions are Too Slow to Complete

International transfers can take days to arrive. The delays come from multiple intermediaries, slow processing systems, and even internet-related issues.

3. Complicated Rules Can Delay Transactions

Every country has its own regulations for international payments. Identity checks, fraud prevention measures, and local laws can all cause confusion and delay especially if you are not familiar with the process.

4. Lack of Transparency and Control

Costs aren't always clear. Hidden fees, vague exchange rates, and unknown intermediary charges often appear without warning. On top of that, senders are usually left in the dark about where their money is or when it will arrive.

5. Security Concerns

Cross-border payments can sometimes be targeted by scammers or hackers. Without proper security measures, your money might be stolen or redirected during transfer.

6. Payment Failures

Transactions fail more often than you think due to incorrect account details, unsupported currencies, or bank restrictions. Fixing these issues wastes time and effort.

How Fintech Solves These Problems

1. It reduces the cost of sending money

By using real exchange rates and cutting out unnecessary intermediaries, digital platforms keep transaction fees low and predictable. Users see exactly what they're paying and what the recipient will get.

2. It speeds up international transfers

Blockchain and other digital systems create direct payment paths between sender and receiver. These systems work 24/7, allowing easy transactions without waiting for banks to process paperwork.

3. Virtual Accounts Handle Multiple Currencies Easily

Users can now hold and send money in multiple currencies from a single account. This makes it easier to pay or get paid without worrying about poor exchange rates or surprise conversion fees.

4. It gives full visibility into payment status

Fintech payment systems show you exactly where your money is at every step. You'll know when it's sent, when it's processed, and exactly when it will arrive.

5. Smart systems handle complex rules automatically

Advanced verification technology checks identities and follows anti-fraud rules instantly. This lowers the risk of failed transactions and wasted time

6. Automatic checks prevent payment failures

Smart tools verify account details before sending money, making sure everything is correct. These systems can fix formatting issues and confirm accounts exist, drastically reducing failed payments.

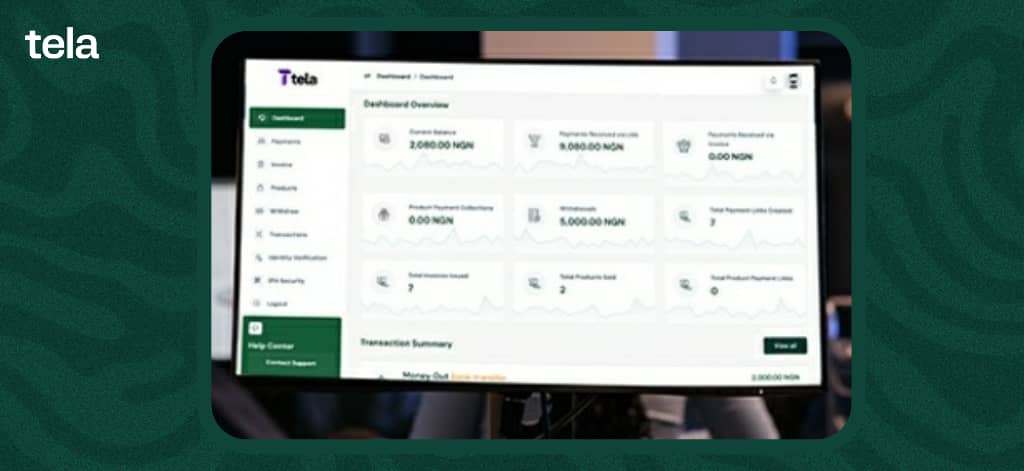

Tela: The Solution to Cross Border Payment

Tela platform is built with African Business in mind, addressing the pain points of traditional payment systems. It provides solutions such as

Streamlined Invoicing:

Tela simplifies invoicing with tools that let you create professional bills in minutes. Clients receive clear invoices with built-in payment options like cards, mobile money, or bank transfers, reducing delays.

Reduced Transaction Fees:

Tela cuts the high costs of international payments. Unlike traditional banks or platforms that take a large chunk of earnings, Tela offers lower fee. Affordable pricing means freelancers and SMes can reinvest savings into growing their business or covering daily needs.

Faster Payment Processing:

Waiting days for payments becomes a thing of the past. Tela speeds up cross-border transfers, delivering funds in hours instead of weeks.

Multiple Currency Support:

Tela allows businesses to receive and hold payments in global currencies like USD, EUR, or GBP. You can convert funds when exchange rates are favorable, avoiding losses from volatile markets.

Enhanced Security Measures:

Tela payment platforms implement robust security measures including:

- Multi-factor authentication

- Encryption of sensitive financial information

- Fraud monitoring systems

- Dispute resolution processes

These security features safeguard your transactions from fraudulent activities especially Freelancers who deals with international clients

Conclusion

Sending money across borders presents a unique set of challenges, but with the right platforms and tools, these barriers can be overcome. Financial technologies have been at the forefront of revolutionizing this space. By using artificial intelligence and blockchain technology, they ensure cross-border payments are faster, more secure, and cost-effective.