The business world is sprinting into a hyper-digital age, a race where cash registers are replaced by QR codes, physical wallets by smartphone apps, and handwritten invoices by instant blockchain transactions. Artificial intelligence is also reshaping industries, changing how businesses transact. Small and medium enterprises (SMEs) are ditching cash registers for digital payment systems at a record speed. Reports show that 76% of adults worldwide now use digital payments, fueled by pandemic-driven shifts and AI-powered fintech innovations (World Bank, 2023). In Africa alone, mobile payments are growing, with over 25.8 billion of the over 31 billion real-time fund transfers made across the continent in 2022 (Statista Report).

This volume of transactions demonstrates the rapid growth of digital payments across the continent. While not every citizen uses digital payments with this frequency, this scale is transforming how businesses operate. For SMEs, digital payments aren’t just a convenience; they are increasingly critical for survival and competitiveness in a rapidly changing market.A McKinsey Report found that Africa's electronic-payments market is expected to grow by 152 percent from 2020 to 2025 .

What Are Digital payments?

Digital payments are transactions executed electronically without physical money. It’s mobile wallets tapping at checkout, QR codes scanned in seconds, or cryptocurrencies settling cross-border deals without banks.These systems thrive on encryption, instant processing, and seamless integration with tools like AI-driven inventory trackers and customer loyalty apps.

Challenges of Cash-Based Transactions for SMEs

While many SMEs have embraced some form of digital payment solutions, a significant number still rely on traditional cash-based transactions. This dependence on cash presents several challenges, including:

1. Security Risks

Cash transactions are highly vulnerable to theft, loss, and fraud. Whether it’s an external threat like armed robbery or an internal issue such as employee theft, handling cash comes with security concerns.

2. Operational Inefficiencies

Time is money, and cash wastes both. Counting, reconciling, and depositing cash is not only risky but also inefficient. These processes consume valuable time that could be better spent on revenue-generating activities.

3. Lack of Financial Transparency

Cash leaves no digital footprint, making financial tracking difficult. Without a clear record of transactions, monitoring revenue, managing expenses, and analyzing cash flow trends become major challenges.

4. Limited Access to Credit

Business loans and credit lines rely heavily on verifiable financial documentation. SMEs that operate primarily in cash often lack the necessary records to prove revenue, making it difficult to secure funding.

A World Bank report found that only 27% of SMEs in emerging markets have access to credit, primarily due to inadequate financial records. Without a trackable financial history, lenders view these businesses as high-risk, reducing opportunities for expansion and investment.

5. Higher Operational Costs

While avoiding transaction fees might seem like a cost-saving measure, handling cash has its own financial burdens: Challenges of Cash-Based Transactions for SMEs

Security expenses: Cash storage and transportation require additional safety measures.

Bank deposit fees: Some banks charge businesses for large cash deposits.

Human error losses: Miscounts, misplaced funds, and fraud all contribute to financial leakage.

6. Tax Compliance Challenges

Cash transactions without proper documentation raise red flags for tax authorities. Many governments are cracking down on tax evasion by promoting digital payments. Businesses without clear financial records may face increased scrutiny, audits, and potential penalties.

How Digitizing Payments Benefits SMEs

1. Convenience

SMEs no longer need to rely on cash or manual invoicing. Digital payments enable transactions anytime, anywhere whether accepting customer payments or paying suppliers. This seamless process enhances customer experience, reduces checkout times, and allows SMEs to focus on scaling their business instead of managing cash logistics.

2. Speed

Delayed payments are a major obstacle for SMEs, with studies showing that over 60% of small businesses experience cash flow issues due to late payments (Forbes) Digital transactions ensure instant or near-instant settlements, keeping businesses financially stable. Faster processing of sales, invoices, and supplier payments means businesses can reinvest revenue more quickly, leading to better financial stability and growth.

3. Security

Handling cash exposes SMEs to theft and fraud, while paper-based transactions increase the risk of accounting errors. Digital payment systems use:

End-to-end encryption to protect data

Fraud detection to prevent unauthorized transactions

Authentication measures to secure payments

Every transaction is recorded, reducing disputes and ensuring compliance with financial regulations, which helps SMEs build trust with customers.

4. Accessibility

For businesses in remote or underserved areas, digital payments eliminate reliance on physical banking infrastructure. Mobile wallets, QR codes, and online payment platforms enable businesses to operate efficiently without a physical presence With global e-commerce projected to exceed $8 trillion by 2027 (Statista) SMEs have a massive opportunity to expand their reach.

5. Cost Efficiency

Traditional payment methods involve hidden costs. Digital payments reduce processing costs by up to 80-90% (McKinsey Report), eliminating the need for manual reconciliation and paperwork. Automated payments also minimize late fees and improve supplier relationships, allowing SMEs to optimize financial operations while keeping costs low.

6. Financial Management

Many SMEs struggle with tracking expenses and reconciling accounts. Digital transactions automate record-keeping, making financial management effortless. With 60% of small businesses using financial software, integrating digital payments simplifies income tracking and expense categorization, ensuring businesses stay financially organized with minimal effort.

7. Automating Business Operations

Digital transactions integrate with business tools to enhance efficiency. Financial platforms automate tasks like invoicing and use AI-powered analytics to generate sales and expense reports. This reduces administrative work, allowing SMEs to focus on growth.

8. Global Reach

Online payments enable SMEs to sell beyond borders, breaking geographical limitations. With the rise of cross-border e-commerce, businesses can accept payments in multiple currencies and expand globally without the complexities of traditional banking.

Tela As a Digital Payment Solution

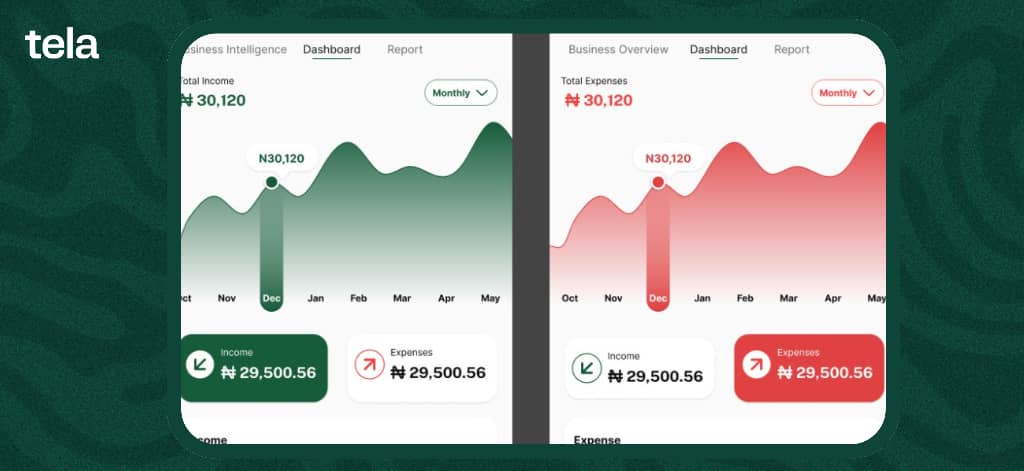

The right digital payment platform can be a game-changer, and Tela is built to give you that edge. As an AI-powered financial companion, Tela helps manage your transactions with ease. You can:

Track all payments and sales in one dashboard for instant financial clarity

Analyze sales trends and risks using AI to make smarter decisions

Automate invoicing and payment tracking to save time and reduce errors

Simplify international payments with multi-currency support

Turn transaction data into actionable insights for business growth

Tela makes digital payments simple, efficient, and growth-focused for SMEs.

Conclusion

Digital payments have become the backbone of modern transactions, offering businesses unparalleled security, speed, and efficiency. As AI-driven fintech solutions advance rapidly, SMEs across Africa are increasingly transitioning away from cash-based systems, embracing smarter, more efficient financial tools. Looking ahead, Tela promises enhanced financial transparency and streamlined operations, empowering businesses to thrive in an increasingly digital economy.