When it comes to running a business, having the right tools to manage finances, track operations, and gain actionable insights is no longer optional. It's essential. Tela provides the tools and solutions both freelancers and SMEs need to manage their financial operations. Using artificial intelligence, Tela simplifies business financial processes, turning data into valuable insights that empower businesses to make smarter decisions.

What is Tela?

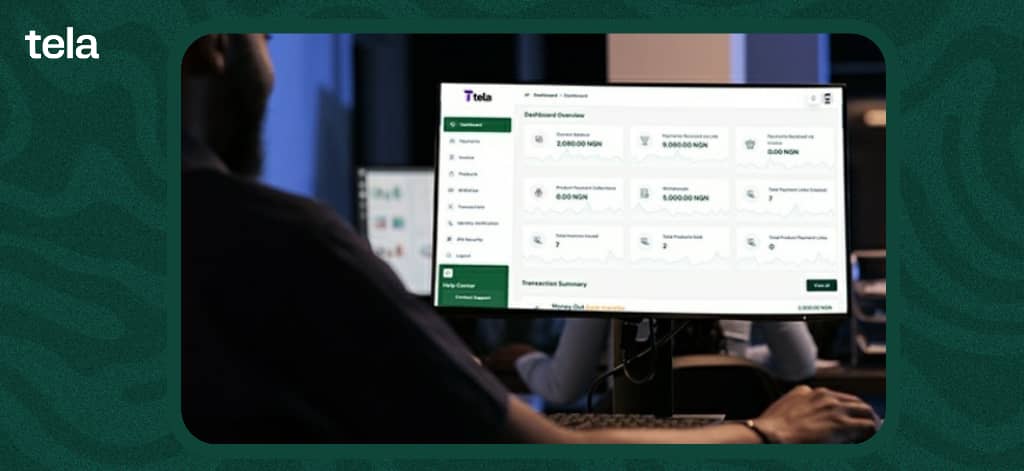

Tela is an AI-powered business intelligence platform designed for small and medium-sized enterprises (SMEs) and freelancers. It provides financial tracking, automated reporting, and collaborative tools like smart invoicing and payment processing to streamline operations. Tela takes the stress out of managing your business by simplifying complex financial processes. It offers clear insights into your cash flow, expenses, and profits, while enabling smooth international payments all in one place.

Key Features of Tela

Financial Management

Tela provides an interactive dashboard, where you can easily track expenses, revenue, and cash flow, helping you to monitor all your transactions at your fingertips.

Business Intelligence

Tela as a business intelligence platform leverages AI to turn your complex data like transaction patterns, seasonal trends, and customer purchase behaviors into meaningful insights. The AI analytics help you understand which products or services are most profitable, helping you in resource allocation and business strategy.

Cross-Border Payments

Tela simplifies international transactions. You can send and receive money without worrying about fluctuating exchange rates or high fees.

Smart Invoicing and Payment Processing

The automated system handles your billing needs efficiently. You can create and send professional invoices using customizable templates that reflect your brand identity.

Recurring Payments with Tela

Tela automates and manages recurring payments for subscriptions, rent, utilities, and more. Set up flexible automatic billing cycles (weekly, monthly, quarterly, or custom) with timely processing and automated reminders before due dates.

Collaboration Tools

Teams can work together efficiently, sharing data and updates. Every member of your business team can access instant information on expense tracking and financial reporting.

How Does Tela Work?

Simplifying Financial Processes:

Tela categorizes your financial data like income sources, recurring expenses and tax obligations offering a clear view of cash flow, expenses, and profits in one place.

App Integrations:

Tela effortlessly connects with tools like inventory management and accounting apps. By syncing with your bank accounts, Tela creates a unified system where you can see all your payments for smoother operations. This integration reduces the need for manual data entry across multiple platforms.

User-Friendly Dashboards:

As a freelancer or entrepreneur, Tela gives you an easy-to-use and customized dashboard where you can see your expenses, sales, profit, and other bills at a glance. Dashboards can be personalized to highlight the metrics that matter most to your specific business model.

Why Businesses Choose Tela

Easy Access

Tela's artificial intelligence platform means you can check your data wherever you are, at the office or on the go. The mobile-responsive design ensures a smooth experience across devices, allowing you to manage your business finances anytime and anywhere.

Growing With Ease

As your business evolves, Tela grows with you. Whether you're taking on more clients, expanding your team, or adding new projects. Tela allows you to activate additional features as your business requirements change.

Affordable for All

With budget-friendly pricing, Tela offers high-end features without breaking the bank, making it perfect for small teams and startups to benefit. Transparent subscription plans allow users to select the package that best suits your current needs.

Advanced Technology

Powered by artificial intelligence, Tela tools are designed to help you remain flexible and responsive to any industry trends or market demands.

How to Get Started with Tela

Sign Up: Visit Tela's website and create an account using your email address.

Register Your Business: Add your business details to set up your financial tracking.

Customize Your Dashboard: Tailor the platform to suit your business needs, from invoicing to expense tracking. Choose from pre-built templates or create a completely custom setup.

Integrate with Other Tools: Link Tela to your bank account or with tools you already use for your workflow.

With these steps, you'll be ready to use Tela to streamline your business operations

Frequently Asked Questions (FAQs)

Who can use Tela?

Tela is ideal for freelancers, SMEs, and businesses looking for easy-to-use financial management and business intelligence tools.

Is Tela secure?

Absolutely. Tela uses Payment Card Industry Data Security Standards (PCI DSS) where all your sensitive financial information and transaction data are protected from payment fraud and unauthorized access.

How does Tela help with automation?

Tela automates tasks like invoicing, payment reminders, and expense tracking, saving you time and effort.

Is Tela Another AI?

No, Tela is not another AI, neither is it called Tela AI. Tela leverages Artificial Intelligence to simplify and manage business finances.